stock option sale tax calculator

This permalink creates a unique url for this online calculator with your saved information. Locate current stock prices by entering the ticker symbol.

How Stock Options Are Taxed Carta

Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in.

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

. Options Profit Calculator provides a unique way to view the returns and profitloss of stock options strategies. The actual gain on the sale of the stock is 1000 30 Sale Price - 20 Exercise Price 10 10 x 100 shares 1000 Actual Gain From Sale In this example the amount that. Ad Your Equity Administration Deserves Industry-Leading Strategies from Fidelity.

Ad Your Equity Administration Deserves Industry-Leading Strategies from Fidelity. Nonqualified stock options have a pretty straightforward tax calculation eventually well build a calculator for you to use. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes.

Ad Offering You Simple And Easy-To-Use Tools For Your Maximum Confidence This Tax Season. Open an Account Now. For this calculator the current stock price is assumed to be the strike price.

40 of the gain or loss is taxed at the short-term capital tax. How much are your stock options worth. To start select an options trading strategy.

Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO. Since the spread on an NSO is treated as. Open an Account Now.

The Stock Option Plan specifies the total number of shares in the option pool. 60 of the gain or loss is taxed at the long-term capital tax rates. If you exercise a non-statutory option for IBM at 150share and the current market value is 160share youll pay tax on the 10share difference 160 - 150 10.

Ad Trade with the Options Platform Awarded for 7 Consecutive Years. The Stock Calculator is very simple to use. Just follow the 5 easy steps below.

Ad Trade with the Options Platform Awarded for 7 Consecutive Years. Your basis in the stock depends on the type of plan that granted your stock option. Basic Long Call bullish Long.

The stock options were granted pursuant to an official employer Stock Option Plan. Please enter your option information below to see your potential savings. The underlying stock price must exceed the strike.

Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the. The Stock Option Plan. The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37.

The strike price is the stock price that your options were issued at. Section 1256 options are always taxed as follows. Click to follow the link and save it to your Favorites so.

Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the.

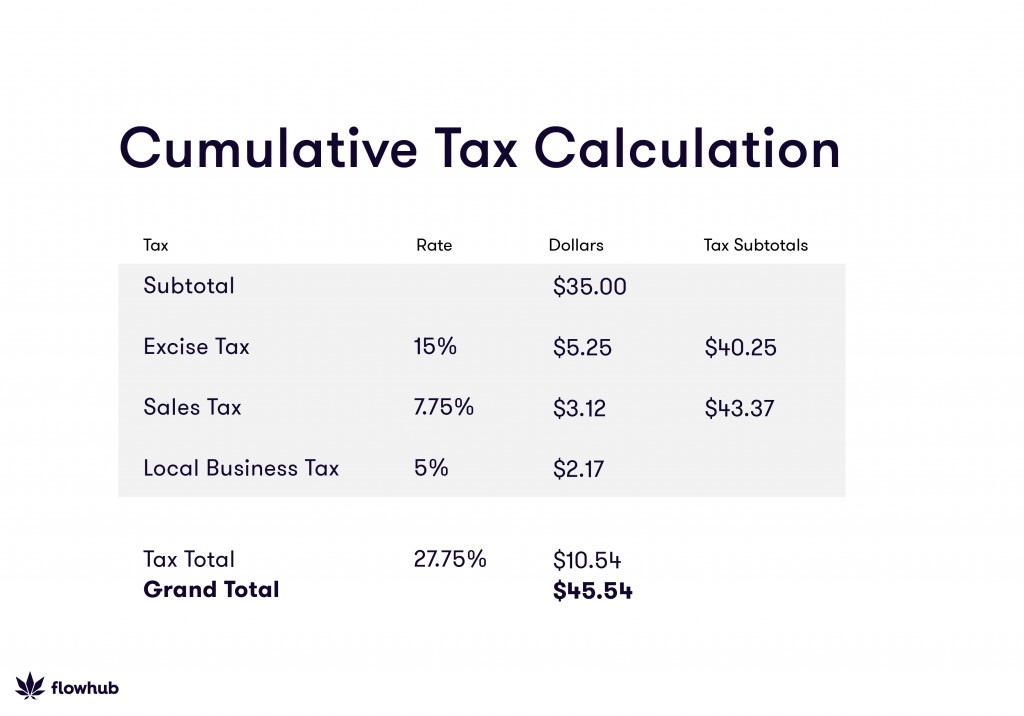

How To Calculate Cannabis Taxes At Your Dispensary

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

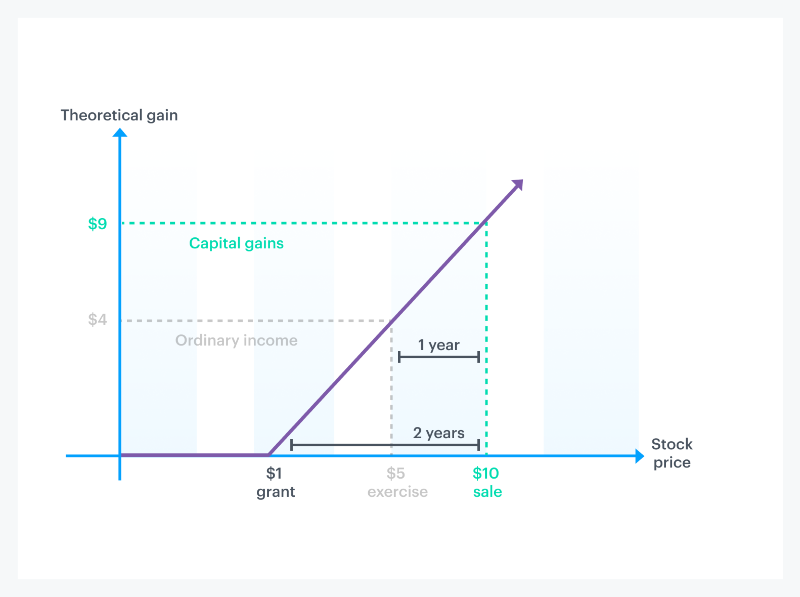

Get The Most Out Of Employee Stock Options

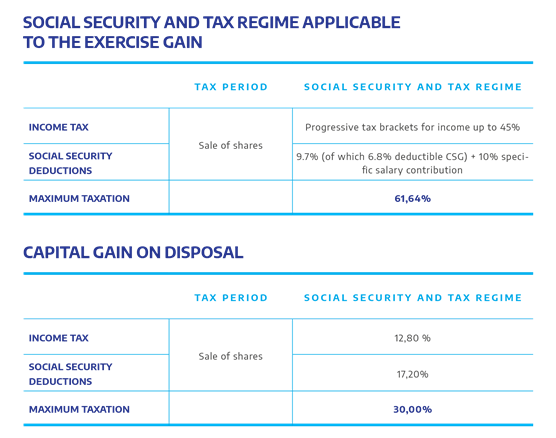

Iso Vs Nso What S The Difference

Reverse Sales Tax Calculator 100 Free Calculators Io

How To Calculate Cannabis Taxes At Your Dispensary

Selling Stock How Capital Gains Are Taxed The Motley Fool

How Stock Options Are Taxed Carta

Is Life Insurance Taxable Forbes Advisor

How To Calculate Sales Tax Video Lesson Transcript Study Com

How Stock Options Are Taxed Carta

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Day Trading Taxes How Profits On Trading Are Taxed

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Reverse Sales Tax Calculator 100 Free Calculators Io

Understanding How The Stock Options Tax Works Smartasset

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)